Tips for the PCOR — Preliminary Change in Ownership Report

Templates and Forms

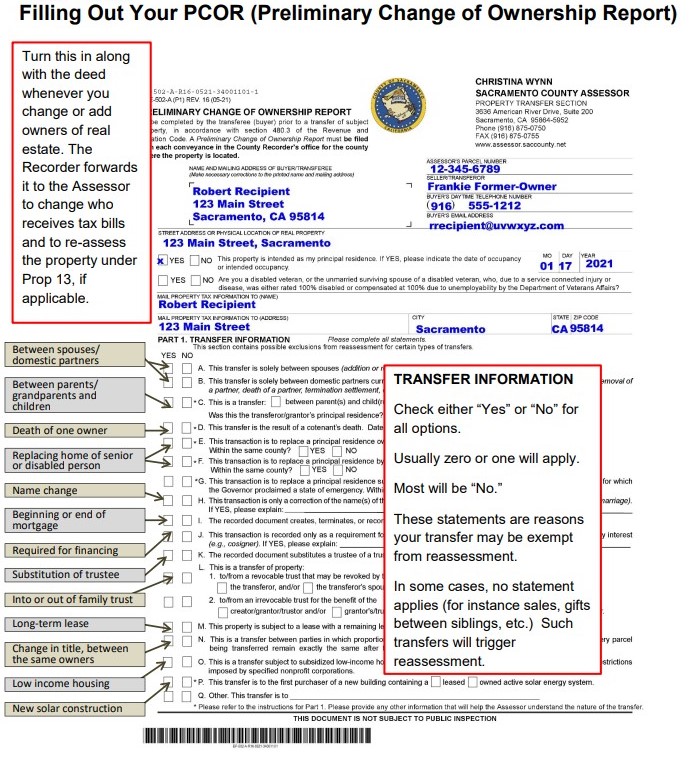

The purpose of the Preliminary Change in Ownership Report, or PCOR, is to alert the county Assessor that a piece of real estate has a new owner. This form must be turned in to the Recorder’s office along with the deed or affidavit that changes ownership; the Recorder sends it to the Assessor.

The Assessor uses the PCOR information to update the tax records to the new owner. The Assessor will also re-assess the property value, and the property tax will probably go up. (Under California’s Prop 13, real estate owners pay taxes based on the property value when they got the property, plus 1% per year.) There are exclusions from re-assessment, and the PCOR indicates whether one of the common exclusions apply.

Sales, Gifts and Inheritance All Use this Form

People commonly ask us, “I didn’t buy the property, I got it as a gift or I inherited it. But the form keeps asking for ‘buyer’ information. Do I have to fill it out?”

Yes. For the purpose of the form, the new owner is the “buyer/transferee” or “buyer” even if they didn’t pay anything. The old owner is the “seller/transferor.” If this transaction is a gift or inheritance, some of the language will seem awkward. But all sections should be filled out, even for gifts.

Tips for Filling out PCOR

Part 1: Transfer Information

These options are reasons your transfer may be excluded from reassessment under Prop 13.

Check either “Yes” or “No” for all options. Usually zero or one will apply, and the rest will be “No.”

In some cases, no statement applies (for instance sales, gifts between siblings, etc.) Such transfers will trigger reassessment.

Part 2: Other Transfer Information

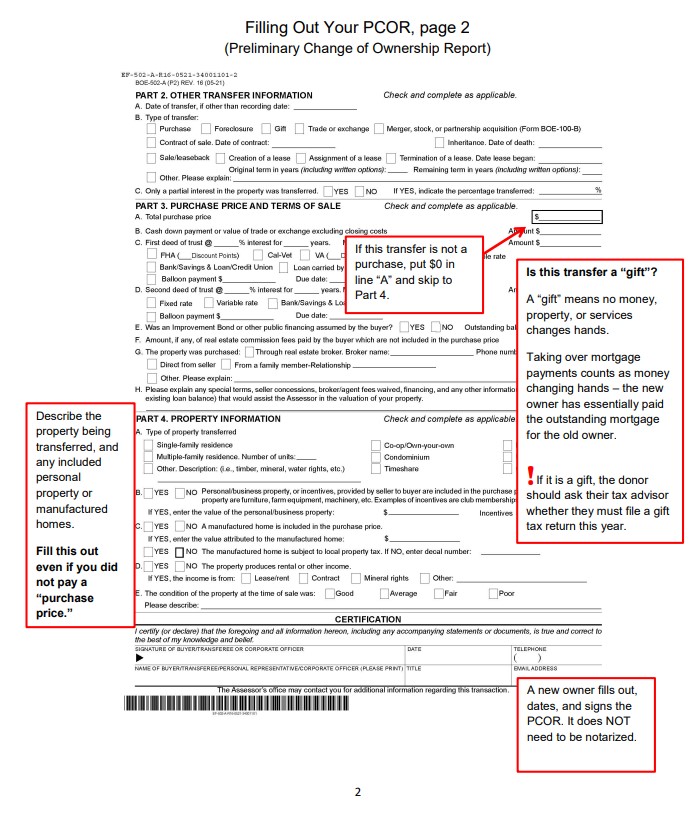

In Part 2B, only one option should apply.

Part 2C is asking if the owner added someone but did not take themselves off (ex: adding someone as a joint tenant).

Part 3: Purchase Price and Terms of Sale

Fill this out even if you did not pay a “purchase price.” If this transfer is a gift, put $0 in 3A and skip to Part 4.

Note: A “gift” means that no money, property, or services changes hands. Swapping property, taking over mortgage payments or bond payments, or adding someone because they agree to live with you as a caretaker are not considered gifts.

If it is a gift, the donor should ask their tax advisor whether they must file a gift tax return this year.

Part 4: Property Information

Fill this out even if you did not pay a “purchase price.” Describe the property being transferred, any included personal property (appliances are common), whether there is a manufactured (mobile) home on the property; and whether the property generates rental income.

For More Information

Samples

PCOR Instructions (page 1)

PCOR Instructions (page 2)

This material is intended as general information only. Your case may have factors requiring different procedures or forms. The information and instructions are provided for use in the Sacramento County Superior Court. Please keep in mind that each court may have different requirements. If you need further assistance consult a lawyer.